Why Most Day Traders Lose Money

- Home / Non Member Articles (Free) / Why Most Day Traders Lose Money

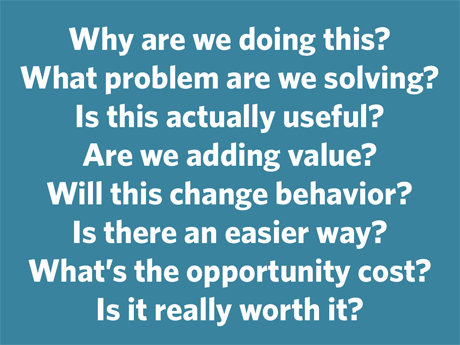

Have you ever asked yourself why most day traders lose money when trading the markets? It’s really an age old question, and while there are many different reasons that you can attribute to day trading losses, there are really two major reasons why the majority of day traders lose money when day trading. The number one reason that many traders lose money is because they do not have a consistent trading strategy that actually works. Secondly, and really just as important though, most traders do not have the mental and emotional stability that it takes to become a profitable day trader. When you combine both of these two reasons, which no single trader is immune to, you quickly find that the odds are stacked highly against new successes in this business.

Think about your own trading for a minute. How many books, websites, courses and other ideas have you pursued while trying to become a profitable trader? If you are like most new day traders, you either read the latest new book or took the latest trading course offered by some professional trading expert that has all of your answers. You read the book or work quickly through the course, and then you are ready to make your fortune. However, in reality, you try and put the system into practice a few times and it loses money and you are then on to the next great trading plan. You probably never stick with the ideas long enough to really learn them, because you feel like they don’t work since you were unsuccessful with them. In some cases, the ideas truly do not work, but in most cases, you just didn’t realize that it takes longer than a few days to learn how to trade the strategy properly. In fact, it takes longer than a few weeks and even months in most cases, but very few traders are willing to put in that amount of time to learn anything, much less how to day trade.

Even if you manage to find a good trading strategy and learn it, there is still the secondary aspect of learning to handle the emotional aspect of day trading. Whenever you put your hard earned money on the line, fear and greed will quickly take over and cloud your rational thinking. I don’t care who you are, or how much money you have, you will have difficulty making money with even the best trading strategy early on due to the fact that the fear of losing will talk you out of the best trades and the fear of missing out on a good move will talk you right into some of the very worst trades. I see this every single day with new traders, so I know it’s a very truthful and real aspect for new traders trying to break into profitable day trading. Plus, I have actually experienced it myself, so I remember making those same mistakes during my learning period.

What you must understand is that learning to day trade is a long term journey and not a sprint. Think about other professional careers that pay very well and how much time, effort and practice most people must put into them before becoming successful at them. Think about Doctors, Lawyers or even professional athletes and how much study and practice they put in to become the best at their professions. These people go to school for years, and then they often struggle to learn their jobs in the early days while working very hard to get experience and on the job training. Before most make their fortunes, they have spent a fortune on their education and training, not to mention how long they actually have to practice what they do before they become one of the very best.

How many court trials does it take before the best lawyers really learn their trade? How many surgery’s does a surgeon perform before he becomes one of the best heart surgeons in the world? Surely most have failures before they began to see their greatest accomplishments. Understand that day trading is no different than any other high paying profession. If it was easy to enter this field, everybody, including doctors and lawyers would want to be day traders. It’s really a tough profession that takes a lot of time and effort to learn! If you want to become a profitable day trader, be prepared to put in your time earning your degree and gaining the necessary experience that it takes. This is usually many, many months if not many years for most people.

Our opinion is that you should begin your learning experience on a live simulator that uses a live data feed. Everything should be equal to and exactly like live trading with the exception that you will use fake money. You should stay on that simulator until you can double or triple your starting account. Even then, you are still going to have to go through part two of the journey, which is then to start small on a live account with real money and work through the emotional issues that will be slightly different when trading with your real and hard earned money versus trading on the simulator. If you trade small and follow the rules we teach, even if you lose a lot, you shouldn’t lose a lot of money. What you do lose you must chalk up to the cost of your education, so be prepared for that part of the learning process.

If you can trade successfully on the simulator, then you know if you can recreate those same decisions in real time, you should be able to make money when trading with your real money. It’s not as easy as that though, I can assure you. However, it can be done, just be prepared for reality and understand that you can not start making money in a few weeks or months most likely. If anyone tells you that you can make money tomorrow with their system, then question that very closely, because if it sounds too good to be true, then it probably is too good to be true!

In closing, you should remember that day trading is a two step learning process. Step one is finding and learning a good trading strategy that actually works, and step two is working through the mental and emotional issues that come with day trading. If you understand that these two pieces of the puzzle are real and that they must be conquered before you can obtain success, then you will know and understand why most day traders lose money. One thing we can help you with here at Price Action Trading System is the fact that we have one of the best day trading strategies available in our price action trading manual. In our opinion, anyone that is profitable at day trading can actually read a price chart, even if they don’t really understand that what they are doing is called price action trading. If you would like to learn more about our day trading strategies, please go to http://priceactiontradingsystem.com/pats-price-action-trading-manual.