How Two Legged Corrections Are Used In Price Action Trading

- Home / Non Member Articles (Free) / How Two Legged Corrections Are Used In Price Action Trading

Today we are going to discuss how two legged corrections are used in price action trading. These corrections or pull backs in a trending market are just that, a temporary correction in a market that is trending. This single pattern or set up is one of the most reliable trading patterns that we use in our daily trading. Two legged pullbacks work so well and so often that they are hard to ignore, and if you used this single pattern alone to trade, you could make a great living in any of the futures indexes or even trading most high volume stocks. It’s amazing as to how many traders are wowed by this very common and very simple pattern when we point it out to them. It’s such an easy set up to learn and watch for that it is simply over looked by most traders. In fact, the pattern actually works against most traders, as it lures them to enter counter trend as they are looking for tops and bottoms in a trending market.

A two legged correction is actually a continuation pattern in a trending market, but since most losing traders are too busy looking for tops or bottoms, they actually get tricked and enter with the correction, when in reality, they should be entering with the trend. If you are struggling to make it as a day trader, learning to stay with the trend and learning to enter on pullbacks, particularly two legged pullbacks, could change your trading results immediately for the better. Trends will normally continue until you get a reversal pattern, which normally comes after a trend line break and a new extreme in the direction of the trend. If you don’t get any other part of this article, just understand that trends continue much further than most expect, and it’s almost impossible for most traders to pick the tops or bottoms of a trending market, so don’t even try to do it. Picking tops and bottoms is almost always a losing strategy! If a trader can learn to find the trend lines and then learn to stay with the trend looking to enter only on corrections or pullbacks to the EMA and/or trend line, particularly two legged corrections or pullbacks, you will almost always immediately improve your odds of a winning trade.

The problem lies in that these two legged pullbacks look more like a topping or bottoming action, depending on trend direction, so they fool the weak traders that do not understand how price action works. When a trending market reaches temporary resistance or support, many traders will look to take profits or exit their positions, and this invariably looks very much like prices have reached their limit, so weak traders look to enter counter trend, hoping for a big payoff by entering long at the lows or short at the highs of a trend that is about to reverse. What happens though is that these traders are simply missing the perfect opportunity to enter with the trend with very little risk. When these two legged corrections or pull backs are to a 21 bar EMA or to a well established trend line, they are almost sure things and about as close to the holy grail of trading as you will ever find.

Below is an excerpt from an article I found at www.swing-trade-stocks.com. It talks about the importance of learning to trade pullbacks in a trend as well, so I thought it complimented this article really well and I wanted to share it with you. Here is what the article had to say.

Buying weakness and selling strength is the art of buying pullbacks. Stocks that are in up trends will pull back offering a low risk buying opportunity and stocks that are in down trends will rally offering a low risk shorting opportunity.

As a swing trader, you have to WAIT for these opportunities to happen because…

Doesn’t it make more sense to buy a stock after a wave of selling has occurred rather than getting caught in a sell-off?

Doesn’t it make more sense to short a stock after a wave of buying has occurred rather than getting caught in a rally?

Absolutely! If you are buying a stock then you want as many sellers out of the stock before you get in. On the other hand, if you are shorting a stock, then you want as many buyers in the stock before you get in. This gives you a low risk entry that you can manage effectively.

This is the most reliable type of entry into a stock and this is the likely area where institutional money is going to come into the stock. If you only trade one pattern, this should be it! You can get into a stock at the beginning of a trend, at a point of low risk, and you can take partial profits and ride the trend to completion! What more could you ask for? You can read the entire original article here.

Obviously this article is talking about stocks, but these two legged pull backs are price action patterns that work in any market, so you can use this trading strategy in stocks, futures or Forex depending on your market of choice. What really intrigued me about this article was the very last paragraph of the excerpt, so make sure you read it a couple of times if necessary so that it soaks in for you. Just like we stated early in our article, this particular writer understands that this single pattern is one of the most reliable types of entries into a trade, and they also get it, because they talk about picking entry points where the institutional type traders will be entering, and these two legged pull backs are the likely spots, so learn to pick them out on your trading charts.

While we try to stay away from any type of indicator in our price action trading strategy, the one thing we do believe in is the 21 bar EMA. Mostly because this 21 bar EMA is where most of your best trade entries will set up. When you have a trending market and it hasn’t corrected in a while, but then suddenly has a two legged pullback or correction that finds support at the EMA in an uptrend, or resistance at the EMA in down trend, then that is where you should look for a place to enter with the trend. These are the perfect set ups, and even though they will look like a weakening trend that is setting up for a counter trend trade, you must learn to resist the temptation to counter trend trade and instead, enter only with the trend. By forcing yourself to do this, you will eventually learn through reward that these are indeed high probability trade set ups that are easy money entries.

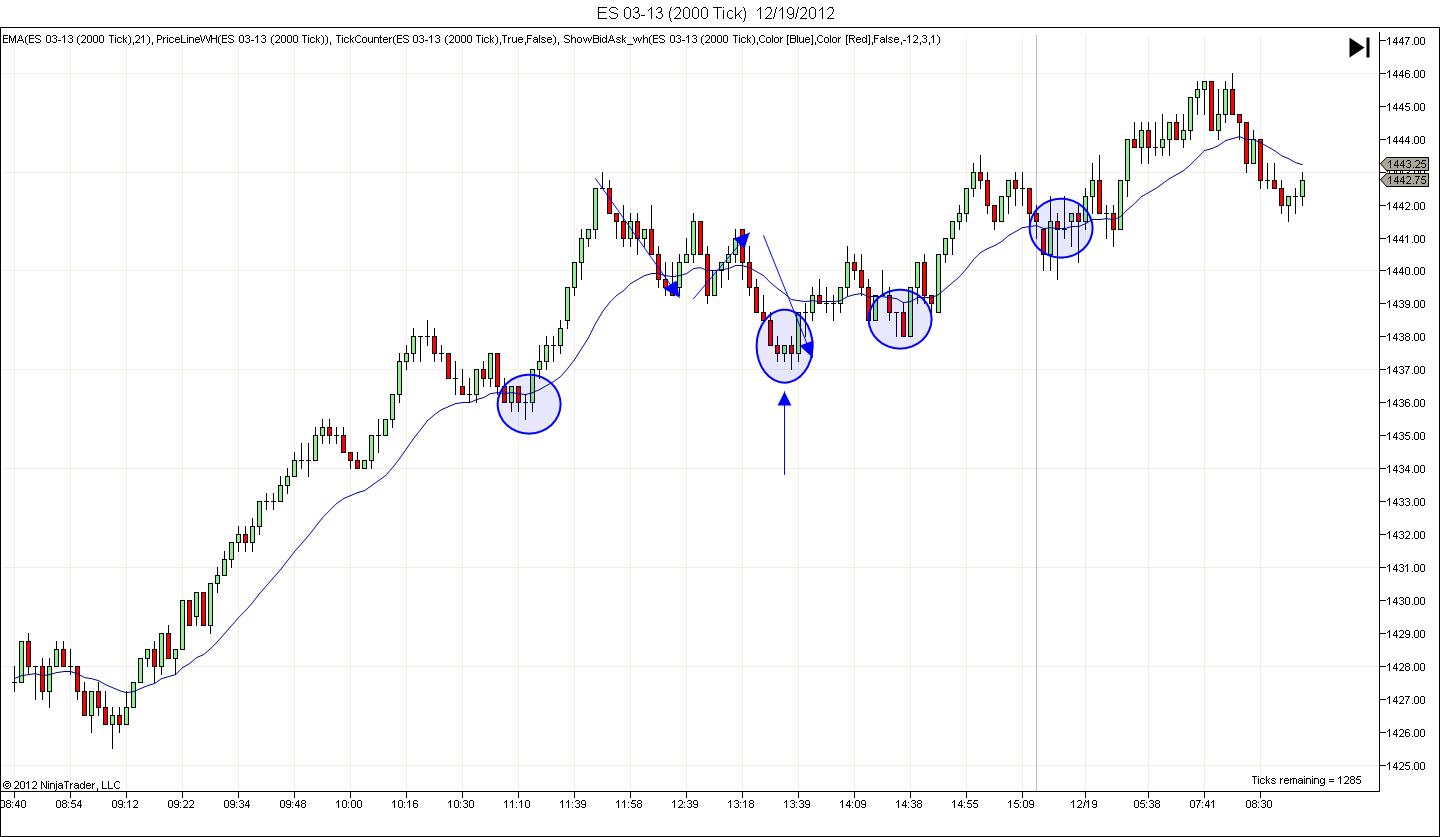

Below is a chart I pulled with a few examples. I circled the entry areas with a blue circle to help you identify the entry point following the two legged pull back, and so you can see what these two legged corrections look like. Notice the one circle with the arrow pointing to it. That is actually a two legged correction with a small two legged correction separating the two legs. You will see this occasionally, but it’s simply a larger pattern with a larger correction.

Notice that if you had entered with the trend after any of these two legged corrections, that you would have had a nice opportunity to make money with very little risk. This ES chart offered a nice opportunity to make multiple points with a very small stop by simply watching and waiting for a two legged pull back or correction to a 21 bar EMA. How could it get any easier than this? Hopefully you can now see how two legged corrections are used in price action trading for easy with trend entries. If you would like to learn more about how to trade these two legged pull backs or even how to use all of our price action knowledge to trade like a professional trader, then you can find that information at http://priceactiontradingsystem.com/pats-price-action-trading-manual.