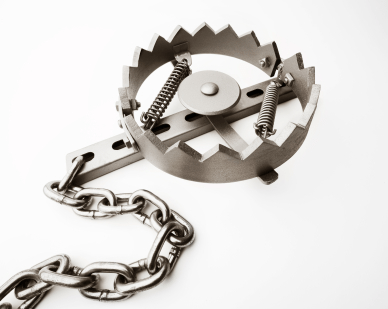

Trading Traps in the ES – The Perfect Price Action Scalp Entry

- Home / Non Member Articles (Free) / Trading Traps in the ES – The Perfect Price Action Scalp Entry

If you are not familiar with trading traps in the ES – The perfect Price Action Scalp Entry, then you are missing out on one of the best scalping entries available. Continue reading about trading traps in the ES – the perfect scalp entry! Traps occur often and the name is a very good descriptor of what actually takes place. There are many reasons why traps occur, and there are several different ways to approach them. What actually occurs with these traps is that multiple traders will enter a trade at the same location, which is usually a tick above or below a previous bar. However, immediately upon entering the trade, the market will instantly reverse on them, trapping those traders on the wrong side of the trade. When the trapped traders realize that they have been duped, they begin exiting on the break of the previous bar. This mass exodus adds fuel to the move and very quickly, the market will surge forward for a couple of points at minimum in most cases.

When you see one of these traps setting up, you want to have a market “stop” order in place exactly where the trapped traders will be exiting. As the duped traders all begin to exit, your order will be executed and you will be swept into the trade with the exiting orders and the move will generally be swift and sudden, making it very easy for you to scalp a point or more before the surge starts to lose momentum. My preferred way to trade these traps is to scalp out with four ticks on one or more contracts, and then move my stop to break even on one or more additional contracts, just in case the move continues even further.

It is difficult to easily describe these traps without a picture, but I will do my best to give you a good mental picture of how these traps will look. Most often, these set ups will occur as a failed break above or below some price level by only a tick or two, then quickly reverse. One good example is a failed break by a tick or two of a small congestion area, which is nothing more than several overlapping bars. Be particularly on alert if the failed break is counter trend. If you see a small congestion area in an upward trending market, and suddenly prices have a one or two tick failed break lower out of the congestion, then that is very likely to act as a trap, as there are many uneducated traders that will enter the market on these break outs only to become immediately trapped on the wrong side of the market.

Another good trap may occur in a pull back. Assume the market is trending downward and prices suddenly start pulling back. At some point the pull back will stall, and then start moving back with the original trend again, only to quickly stall and start back up a second time. If the second attempt to reverse suddenly fails after prices tick higher than a previous bar, there will be many traders that will be trapped to the long side of a declining market. Most of them will be quick to exit as soon as prices start moving down and take out the low of the previous bar. Their exit orders will be within a few ticks of the low of that bar, and that is exactly where we want to have our entry stop order. These trades often move very fast, so you often times need to have your order in place early, anticipating a possible trap. If the trap does not occur, simply cancel the order. By having it in place ahead of time, you assure that you don’t get left behind when prices surge lower.

The two examples just given will produce some of the best traps, but there are other trap set-ups as well. What you must be aware of with the ES is that it usually moves in twos or pairs. The ES market likes to attempt things twice before giving up, and that’s why traps work so well. Most everyone is aware of double tops and double bottoms, and what is actually happening at a double top is that prices try twice to go higher and fail. Simply reverse this for a double bottom. The market will try twice to go lower and fail both times at the same level, and then suddenly reverse the trend. Whenever the market tries to do something twice but fails, it will usually succeed in doing the opposite. Traps are very similar to double tops and double bottoms, with the exception of the fact that the tops or bottoms are not equal to the tick. The right side can be a few ticks higher, or a few ticks lower, but the formation will still work much the same as a true double top or double bottom.

When these traps occur counter trend, the sudden reversal back with the original trend is often times swift or very violent as the trapped traders realize that they were tricked and that the original trend is starting back up again. It’s the same principle of everyone heading for the door at once, and the mass exit creates a vortex that drops or rises quickly depending on which way the market is moving. Study some of your charts each day and look for these traps until you can learn to spot them. Once you get a good feel for what they look like, you can start watching for them in real time. If you learn to spot and trade these formations, you will forever change the way you look at a price chart. Most importantly, you can improve your bottom line by only trading a couple of these each day. Hopefully you now understand why we suggest trading traps in the ES – the perfect price action scalp entry!

This site uses Akismet to reduce spam. Learn how your comment data is processed.

Comments

panny123 March 14, 2014 at

does the rule of two work in other markets why does the es work like it does,what market do you know that do not work like this? thanks mac, and yes i will be trading just the es in future.

Mack March 14, 2014 at

It works in all markets. Just watch one if you have a favorite and see, although you might not see it as often as in the ES.

Saif May 27, 2020 at

Are there any charts that shows how to enter or trading traps? Any reference? I bought the PATs manuels , and it comes with bunch of charts. But not sure where is the traps ones

Mack May 28, 2020 at

The entry is always on a buy/sell stop at the point where there trap occurs. So like all of our entries, you anticipate it possibly happening in advance and you place your order before the failure occurs. The actual failure would trigger your order and stop you into the trade with the momentum. This is the one time too that we do not worry about the type of signal bar. So the signal bar that sets up these traps does not have to be bullish if going long or bearish if going short. They are traps, so the signal bar is likely to close opposed to our entry direction.

Blazin5381 July 1, 2020 at

So we don´t wait until the candle closes before placing the order if we attempt to trade the trap?

Mack July 1, 2020 at

The trap is the reversal and the break above a bar in the opposite direction, so the candle to the left of the break higher is the signal bar.

Blazin5381 July 2, 2020 at

Ah, understood, thank you!