Why Is The Price Action So Boring In The ES

- Home / Non Member Articles (Free) / Why Is The Price Action So Boring In The ES

I got a comment yesterday on one of our YouTube videos indicating that our chart lesson was “boring.” With only two entries during a 45 minute span, I would have to agree that it was indeed some very boring price action when it comes to the ES. Many people continue to ask: Why is the price action so boring in the ES lately, so I thought I would address that in today’s article? While there could be many reasons as to why volume is drying up in the markets, the bottom line as to why our trading is so boring is due to the lack of volume or market participation. For whatever reason, traders are just not participating in the market in the same numbers that they have in the past, so this is affecting the price action.

Nobody wants the market to start trending strongly again any more than I do, because that normally increases profits and the number of trade entries that are available on a daily basis. Just remember this above all though: Profits are the ultimate goal, and if you are trading for excitement, then you are in the wrong business and you should become a professional gambler in the casinos or bet on sporting games instead. There are always bets in those arena’s and they are great places to find the cure for your gambling vices. As for myself, I am not a gambler. I am a day trader that makes his living trading the markets, and I only enter trades when the the odds are in my favor. The minute you begin gambling as a day trader, that is the moment you set yourself up to travel down a path of destruction. Make sure you understand this important difference, because as day traders, we do not want to be gamblers.

We are obviously not the only ones wondering why the volume has been so lackluster in the ES recently. Below is an excerpt we took from an article that was posted at www.CNBC.com. Here is what that article had to say.

With just a few weeks of trading left, 2012 is looking a lot like 2011 in one key regard: Investors still don’t believe in a stock market that keeps moving higher.

This year has been even more profitable than its predecessor, with the 12 percent gain in the Standard & Poor’s 500 easily outdistancing the modest rise in 2011.

Still, volume remains low and money continues to pour out of equity funds and into fixed income and cash.

“If the party is so good…where is everybody?” Nicholas Colas, chief market strategist at ConvergEx, asked in his daily market commentary Thursday.

The question has been asked often around Wall Street this year, with total equity fund outflows totaling $125 billion and nearly $300 billion pouring into bonds. Cash parked in money market funds, with near-zero interest rates, also has been on the rise, with $2.61 trillion tucked on the sidelines, according to the latest numbers from the Investment Company Institute.

Many theories have been expounded to try to rationalize the trend away from stocks.

For Colas, the most rational theory may be found in linguistics. While the current stock market qualifies as a “bull” under the conventional Wall Street definition of a 20 percent increase from a designated bottom, it sure hasn’t felt like it.

Memories of the financial crisis still weigh heavily, while the general lackluster stock market performance over the past 13 years or so has made it hard to justify the risks.

“Bull markets are just as much about investor sentiment as price action. It’s all about the shoeshine boy or the taxi driver dispensing stock tips to their customers and ‘irrational exuberance'” and cocktail party chatter,” Colas said. “By those measures, we remain in a bear market for U.S. stocks, regardless of what the price action may say.” You can read the rest of the original article here.

While there are many other contributing factors, I think a large reason for the low volume boils down to the fact that our economy is in shambles and people are struggling to make ends meet. A lot of it stems from the fact that investors are just not comfortable with the stock markets after the big losses from a few years back, so they are sticking with bonds instead. There is also the fact that people are simply not able to invest at the same rates that they have in the recent past when the housing market and overall economy was booming. Back then, people had extra money to invest and they could afford to stash it away, and in a low interest rate environment, they looked for places to grow their investments, and that was the stock market.

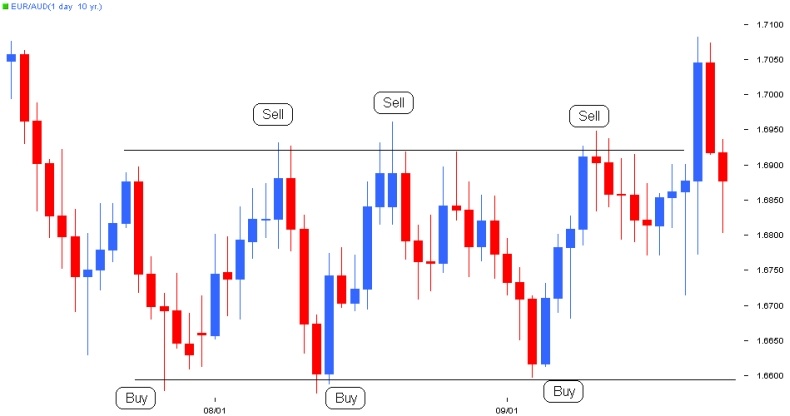

Today however, those same people that were making money and saving it are now using that money to get out of debt and to live off of due to the rising cost of every day living. Until our economy is better and people have additional monies to invest, the volume is likely going to continue to be lower than it has been in the past. These things work in cycles, just like the rest of the universe, and we are simply in a negative cycle for market investments right now, so just be aware of this fact and trade accordingly. If you understand how to trade ranges, which is what you often get when there is low volume, you can still make money. You won’t get as many strong entries, but you will still have a very predictable market in which you can make consistent profits as a day trader. You just have to know how to trade these types of market action properly.

We don’t claim to be economists here at PATs, and the following is just a simplified version of our take to the answer to the question; why is the price action so boring in the ES. While the economy is much more complicated than what we just shared with you, it’s still just a matter of economics, or a lack of cash flow in the end. When money is flowing, people invest it. When money is tight, like it is now, people need it to lower their debt and to live off of, so there is less of it flowing within the economy. At some point in the future, the economy will begin to improve again and money will start flowing once again. That’s when we expect the volume to begin increasing again in the ES. Just be aware that until then, you need to have a solid understanding of how to trade range days, because we will get a lot of these days where the price action is stuck in ranges. Our price action trading strategies work well in any market, whether trending or ranging, and we can teach you how to trade price action in ranges like a professional. If you would like to learn how to trade ranges with our price action trading techniques, you can find more information at http://priceactiontradingsystem.com/pats-price-action-trading-manual/.