How To Use Price Action To Determine The Best Trade Entries

- Home / Non Member Articles (Free) / How To Use Price Action To Determine The Best Trade Entries

Today we are going to discuss how to use price action to determine the best trade entries. This may seem like an obvious article topic, but let me explain further and I think you will see that it is certainly an important topic that many of our followers fail to recognize. Most students do tend to understand that it is very important to determine the type of day that is occurring, but most don’t realize that the “day type” can change instantly, or even that there are multiple day types, all within the same day. Without clearly defining this subject, many traders continue to be confused, so I will give this area some additional discussion today so that some of you better understand what we are attempting to do with the price action.

In reality, the markets can do three things. They either trend upward, trend downward or they don’t trend at all, but merely range. However, even if prices are in a clear and tight range, prices can still trend back and forth between the highs and lows, so prices can still trend even on very tight range days. In addition, even on very strong trend days, prices will often pause to consolidate the moves, so you will get some ranging even then. What traders must understand is that even though we are mostly interested in our range rules on range days, if the range is wide enough, we still have to use our trend rules during the times that prices are trending up and down between the highs and lows. Just as well, when the market is trending, if it suddenly stops and goes into a range, we must now consider using our range rules, even if we only trade one side of the range due to the trend precedent rules. Meaning we only short the high sides of the range if we are in a down trend, or buy the low sides of the range is we are in an uptrend.

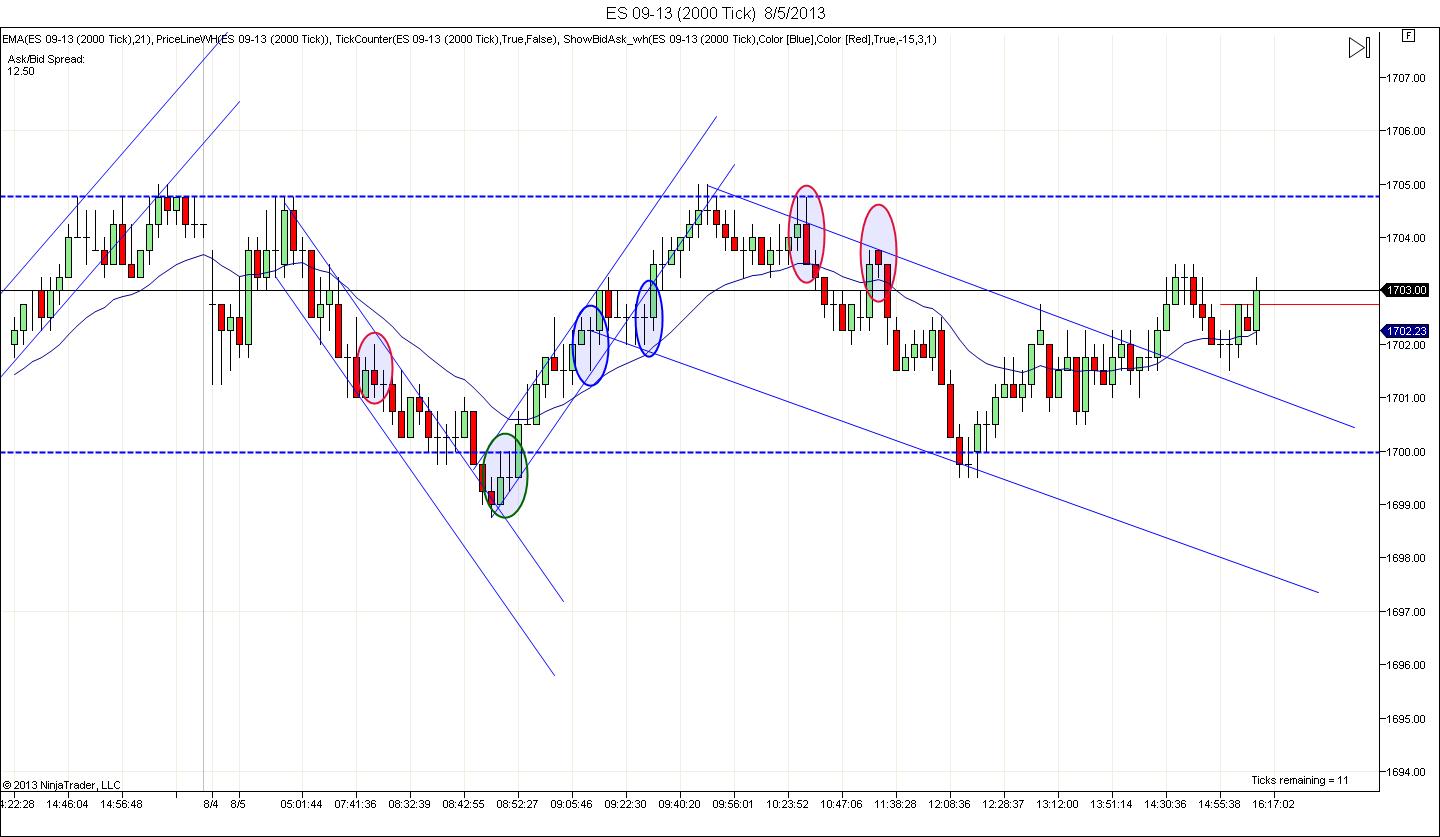

Hopefully you are already starting to see where I am going and now maybe have a clearer understanding of the fact that you can not box yourself into a corner using only range rules or only trend rules. You may have to switch back and forth between the two, depending on what prices are doing that day. Today is a actually perfect example of what I am trying to get across. It is a range day for the most part, with prices being caught in a mere five point range, which is small really. You can see a snap shot of today’s chart below.

Notice in the chart example how the highs and lows of the range are very evident, but at the same time, there are clear trends that go from the highs of the range to the lows, and then reverse and go the other direction. When prices are near the highs and lows of this range, we want to use our range rules to trade, but once prices are trending from high to low or from low to high, we will need to switch to our trend rules in order to enter the best and most probable winning trades. You simply can not get married to one strategy or the other, even if the day appears to be one or the other type of day. You must be ready to switch gears with little thought or little effort when the price action dictates that you must switch. The blue circles on the chart are long entries and the red circles are short entries. Notice that we are taking both long and short trades today, because overall, this is a range day at this point. If prices were trending upwards, we would only want to buy and if they were trending downward, we would only want to sell, but they are not trending overall today, they are merely ranging.

Based on some of the feedback that I received lately, some of you are getting too hung up on trying to determine if it’s a range day or a trend day, and then getting married to that type of strategy for the day, and that simply will not work in the long run. A good trader is flexible and can switch from long to short or short to long in the blink of an eye with little or no hesitation. An inability to switch quickly like this will only slow down your ability to be a successful trader in the long run. Notice that I am taking both long and short trades on this day. The overall strategy is that this is a range day, and there really is no longer term trend bias on this chart, so we can go short or long depending on need. As prices reach the low of the range and as they trend back to the high side, we are looking for long entries. Likewise, as prices reach the high of the range or trend lower headed to the low side of the range, we will want to look for short opportunities.

It’s really that simple, but knowing how to find the proper entry points and when to enter is hard to trust if you don’t know the proper rules or have a lot of experience trading with our price action rules. If you would like to learn how to use price action to determine the best trade entries, or if you would like to use our price action trading rules to help improve your overall trading results, then you have come to the right place. You can find our price action manual at http://priceactiontradingsystem.com/pats-price-action-trading-manual. This manual will show you in very simple details and explanations, exactly how we use price action to make money trading almost any available market.

This site uses Akismet to reduce spam. Learn how your comment data is processed.

Comments

rsong18 November 8, 2013 at

Mack, there are 3 lines in the chart: the top and bottom of the range and a middle line in the upper portion of the range. It seems to me that you did not take long trade above the upper mid line. Two out of three short trades were taken above the upper mid line. Would you please explain if there is a reason for these? Additionally, how did you get the upper mid line inside the range?

Thanks.

Mack November 8, 2013 at

The middle line is what I call the median line. It’s like a minor sup/res in the middle of a channel. They used to be a rare thing or not that common, but it seems they are becoming almost a daily occurrence lately. Don’t ask me why, as I really don’t know, but it’s something you must be aware of in your trading. It’s less reliable than the main trend line, so I don’t trade it as often unless it continues to prove itself over and over.