More On Price Action Trading Strategies And Breakouts

- Home / Non Member Articles (Free) / More On Price Action Trading Strategies And Breakouts

We have talked about our price action trading rules when it comes to trading breakouts before, but we felt Like we needed to say more on price action trading strategies and breakouts in order to make sure that traders truly understand the dynamics and the importance of trading this common chart pattern properly. If you want to read our previous post on this subject first, you can find that post on trading breakouts here. While most traders struggle when trading ranges, we actually enjoy day trading price ranges, particularly in the ES, because these trading ranges are so predictable.

If you truly understand price ranges and you know how to read a price chart, then trading ranges becomes much easier. On the other hand, if you follow most of the written documentation you see posted around the Internet about how to trade price ranges, then you will probably struggle to trade these ranges properly. Also, most traders don’t know how to read a price chart at all and they have problems or difficulty in recognizing price ranges unless they are very obvious and long term. Even if these traders manage to recognize the range, they don’t understand price action, so they don’t really understand what actions to take or how they should properly trade the price range.

This is the basis of why we want to write more on this subject, so even if you think you know how to properly trade a price range, you should take the time to read and study the information that we are about to share with you in this post. Most everything we read about trading price or trading ranges is that you should attempt to buy a break out to the high side or sell a breakout to the low side. This is completely wrong, and exactly the opposite of what you should be doing in most cases. We will try and explain to you why this is the case, and why our price action rules say that you are better off buying breakouts to the low side and selling breakouts to the upside.

Whenever you find an area of strong support or resistance, you can count on that area having very high volatility, because so many traders are watching those areas and making plans to enter the market if and when prices reach that area. There will be an excessive number of resting orders sitting at and just beyond these strong support and resistance areas, so this will increase the volatility considerably. Any time you reach an area that is highly visible by many traders, you can expect very high volatility, because many traders are going to enter the market at those locations, even if they are entering on the wrong side. Just understand that these areas are highly volatile due to all of the resting orders that accumulate here, as that is the main point at this stage of our post.

Here is what James Stanley had to say about breakouts in a recent article posted at www.smh.com.au.

Trading breakouts involves looking to enter trades with breaks of support and resistance levels. If it’s a resistance level getting broken, breakout traders want to look to go long. If it’s support, traders want to look to go short.

The idea is that support/resistance can serve as an impediment to future price movements. When these levels get broken, that impediment is thought to no longer exist; and traders look to take price higher with long trades or price lower with short trades.

Unfortunately, learning to trade breakouts may not be so simple.The reason for this is because the very thing that makes breakouts attractive, volatility, also makes them dangerous. In this article, we are going to address the topics of breakouts, and maybe more importantly – how traders can customize their approaches for trading in these attractive, yet potentially treacherous conditions. End of article quote.

Hopefully you now understand how volatile these areas can be for traders. Now let me explain what is actually taking place so that you will understand why most breakouts fail, even if only temporarily. Once you understand what’s happening, it should be easier for you to understand the appropriate action to take when entering the market at the highs and lows of these ranges.

When prices are in a trading range, there are many strong handed traders that are looking to get short and long. They are looking to buy when prices approach support and sell when prices approach resistance, expecting that the range will continue to hold The traders that are looking to get short are placing sell stops at and above the highs of the range, as they feel that is the logical place to enter the trading range. The longer the range lasts, the more the sell orders will accumulate at and above the highs.

There will also be a lot of traders that will be looking to buy the lows of the trading range, and they will place their buy stops near and below the lows of the range, as that will be the logical place for them to enter long should prices reach the strong support areas of the trading range. Again, the longer the range remains in place, the more buy orders that will accumulate at and just below the strong support area. Hopefully you are starting to see the value in understanding this already?

Here is more of what James Stanley had to say about prices breaking through a strong price range.

False breakouts can be abundant, and since we know that most breakouts will occur around volatile periods in the market (when price can move for, or against us for an extended period of time); breakout traders want to look to risk management in an effot to mitigate the damage brought upon by false breakouts. This is where stop-loss orders and strong risk management can help.

The Risk Management of Breakouts

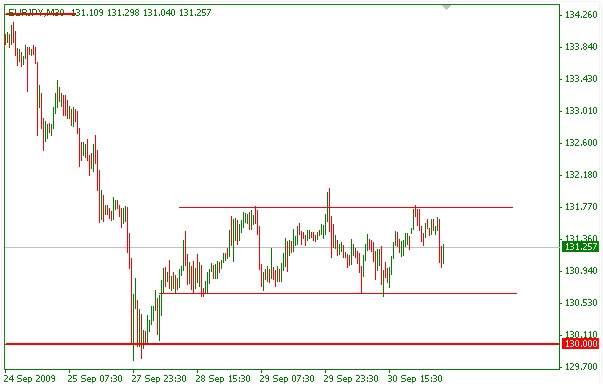

As mentioned on the chart above, false breakouts are the nemesis of the breakout trader. This is because false breakouts can move against the trader’s position for an extended period of time, potentially wiping away the gains of many successful trades. You can see the original article here.

While we don’t disagree with the importance of risk management at all, we do not think that is the most important part about how we choose to enter in trading ranges. We are more concerned about the high number of false breakouts. Unless the market was trending strongly when it went into the trading range, it is unlikely that any breakout will continue to trend strongly in the direction of the break out. Even if prices do continue to trend strongly in the same direction of the breakout, they will normally pull back and test that breakout area before moving very far, so there is a very high likelihood of a failed breakout in most cases, even if the failure is only temporary.

The proper way to trade the breakout is to fade it, or take an entry in the opposite direction in most all cases. More times that not, you will catch the low of the trading day by buying the break lower of a strong trading range. If prices break out to the high side, you will normally be better off selling the breakout, and many times you will catch the very high of the trading day by doing so. At the very least, you will get a strong pullback that will allow you to make a quick profit.

The reason prices reverse off of the low breakouts is because of all of the buy stops that have accumulated there. Also, the smart traders that understand how to read a price chart realize that the odds are better to buy low and sell high, so they are looking to buy low areas for quick moves higher, so there will be many strong buy orders resting below the trading range support in most cases.

In addition, there will be weak traders or those that think selling the breakout is a smart move, so they will be getting short on the break lower and long on a break higher. However, they will quickly see prices moving against them, so they will start buying back their shorts or selling their longs, creating momentum to that causes the breakout to quickly reverse.

As the move gains momentum, the momentum traders will see a chance to buy low on strong upward momentum and sell high on strong downward momentum due to all of the buying or selling pressure, and the breakout will quickly reverse and head back into the range again. This is really just the quick and easy version of what happens.

Blindly buying and selling in the direction of a breakout for any reason, particularly for reasons that are normally taught by the trading gurus is fruitless and will cost you your trading capital in most cases. If you know and understand how to read a price chart, just as we have explained here when it comes to trading breakouts of trading ranges, then you will know when to buy and sell and you will understand why, just as we explained why prices fail on most trading range breakouts.

The only way you enter on a breakout of a trading range is if and when prices pull back and test the breakout area and then reverses back in the direction of the breakout. Otherwise, you only want to fade the breakout or enter in the opposite direction of the breakout. We certainly hope that you have learned more on price action trading strategies and breakouts. If you want to learn even more in regards to understanding price action and how to read a price chart like a pro, then you can find our price action trading manual at http://priceactiontradingsystem.com/pats-price-action-trading-manual/.

This site uses Akismet to reduce spam. Learn how your comment data is processed.

Comments

Lisah July 17, 2014 at

Thanks Mack – i enjoy your easy to read descriptions! Lisa