Is Market Sentiment More Important Than The Price Action

- Home / Non Member Articles (Free) / Is Market Sentiment More Important Than The Price Action

Is market sentiment more important than the price action, or is price action king? We have studied and pondered this quite a bit ourselves, and we think the answer might surprise you, particularly if you are not price action trading already. Our guess is that if you are not a price action trader, your trading results are mixed and probably jaded to the losing side, because we believe that it is impossible to be consistently profitable as a trader without the ability or skill to read a price chart. Even if you do not call it price action trading, if you are a successful trader that consistently makes money month after month, then it is almost certain that you have great chart reading skills, and even if you don’t call it price action trading, that translates into the ability to read a price chart rather well.

Before we go any further, let’s take a moment to clarify both market sentiment and price action trading. Market sentiment is the overall combined thoughts of every individual trader in that market. As an example, if the market sentiment is bullish, then the majority of the individual traders have a bullish stance, and thus the buyers should overwhelm the sellers and the market should go higher. Price action is simply the footprints that are left in the form of bars or candlesticks that print to your chart. You really can’t have one without the other, because both market sentiment and price action are two distinct pieces of the overall market.

Now that we understand that these are separate entities, which one is more important? Our answer might surprise you, and while market sentiment is obviously the overall driver, we don’t think you can accurately predict market sentiment. Market sentiment can change on a dime as well. These facts leave you vulnerable to wild swings and misinterpretations that can cost you dearly. On the other hand, if you wipe your mind clear of any and all biases, and then simply follow the price action, which is actually displaying market sentiment as it happens in our opinion, then you will find that there is not nearly as much uncertainty, and certainly no gambling or guesses in your trade entries.

The following is an excerpt from an article that compares both price action and market sentiment that we found at www.community.nasdaq.com.

Monday and Tuesday of last week, the Dow started down 200 points. This came on the heels of the previous Friday, where the Market was also down over 100 points. Then something happened. Suddenly the Market put on 400 points. What changed? Was it price action or sentiment that changed the Market’s direction?

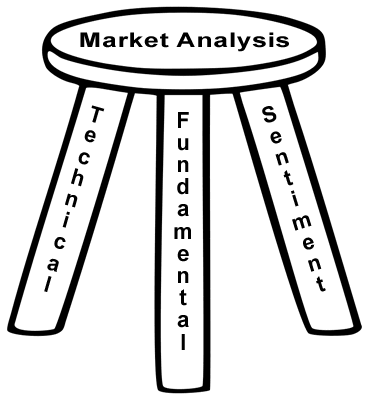

Price has been said to be the best indicator of Market direction. Traders identify price action patterns (price oscillation swings from low to high and vice versa) through technical analysis, such as double tops and bottoms, moving average crosses, MACD, overbought, oversold, support and resistance. For traders, price action patterns imply future market direction. Traders rely on pattern recognition in an effort to succeed. Technical indicators are used as potential stop loss or target levels. Price action is an effective trading system.

But was it price action this week that caused the Market to swing higher by 400 points? Or was it just Market Sentiment?

What is Market Sentiment?

Market Sentiment is the predominant attitude amongst institutional traders, such as hedge funds, mutual funds, etc.. Institutional traders are directly influenced by economic events, assumptions, overall behavior, even gut feelings. Sentiment measures Market optimism or pessimism. Optimistic market sentiment shows market participantswilling to add to their existing holdings and acquire new positions. Pessimistic market sentiment demonstrates that market participants are unwilling to add new positions and are liquidating existing holdings.

This last week was driven strictly by Optimistic Market sentiment. Technical analysis did not warrant a 400 point increase in the Dow. How did market sentiment turn optimistic?

Simple. The ECB spread rumors that it would purchase Spanish debt. There was no official German denial. Merkel was on vacation. Germany’s Finance Minister, Wolfgang Schauble made no statement one way or the other. You can read the entire original article here.

The article itself goes on to talk about how market sentiment could lead to fake outs that fool traders into getting too optimistic or too pessimistic, so they are also indicating that they feel market sentiment can be tricky. They are really arguing the point as to what drove the large frenzy rally last week (week ending 7/27/12). Our point is that if you are following the price action and using it alone as your judge and jury for entering the market, market sentiment does not matter. If you are using the price action itself to keep you informed of what the market is doing and where it’s likely to go, then you have a higher percentage opportunity of getting things correct. You won’t get faked out nearly as often, and if you do, you will realize it quickly and be able to cut your losses short or possibly even reverse your position.

We will ask you the question again now and see how you respond. What do you think? Is market sentiment more important than the price action? Hopefully you responded with the term “price action is the most important factor for day trading any market.” We have found that our trading has improved immensely by ignoring market news, which often drives market sentiment, and making sure we tune it out. In fact, we now believe that the market news is simply made up to match the price action for the day. Trading is a finely tuned and difficult skill, and I doubt there are even a handful of financial reporters that truly understand the markets. If they did, they would be traders and not reporters.

If you choose to follow and listen to market news, you will give yourself a market bias, even if it is only on a subconscious level that you don not even realize. By keeping a clear mind on market direction and throwing away the losing indicators, you can then concentrate on what really matters: The price action of the market. If you want to learn to read a price chart like a professional trader, then you have come to the right place. Take some time to explore our site and get started with our price action trading course today. You can get more information on our price action course at http://priceactiontradingsystem.com/pats-price-action-trading-manual/.